Best Cd Accounts

Here are the Best CD Interest Rates for February 2021. 5 year: Navy Federal Credit Union, APY: 1.01%, $1,000 Min. Deposit; 5 year: Suncoast Credit Union, APY: 0.95%, $500 Min. With a five-year CD rate of 1.10% APY, TIAA Bank definitely offers one of the best CD accounts around, while at the same time charging no monthly maintenance fees. If you want even better CD rates.

- Best Cd Accounts 2020

- See Full List On Investopedia.com

- Best 1 Year Cd Rates

- Best Cd Accounts Online

- Best Cd Accounts 2016

- Jan 08, 2021 CD accounts come in various forms, and it’s up to you to decide which best fits your financial goals. We’ll give you a short explanation of the five most common CD accounts. Traditional term accounts are the everyday certificates of deposit that you can get at just about any bank.

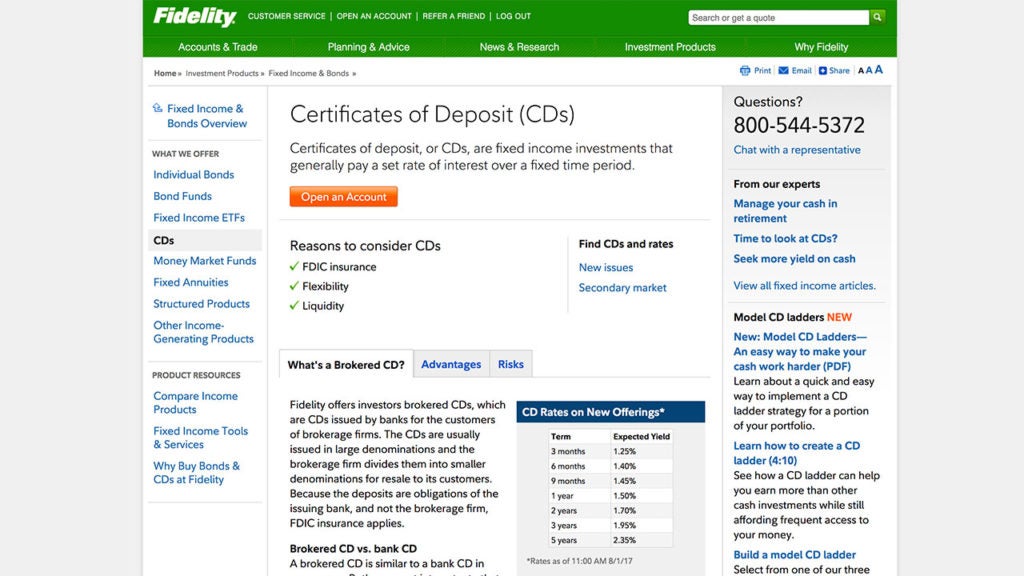

- A CD ladder is a strategy that helps you avoid problems that may arise if you put all of your money into one CD. To use a laddering strategy, purchase multiple CDs with different maturity dates. By doing so, you have CDs mature periodically, and you can use those funds for spending needs.

A certificate of deposit, or CD, is a savings investment insured by the Federal Deposit Insurance Corp., making it a safe way to earn interest at a typically higher rate than you can earn with a savings or checking account. CDs are a good option for savers looking to conservatively generate income.

Popular Searches

In a comprehensive analysis of products and services from 120 banks across the country, GOBankingRates has compiled the best CD rates and accounts of 2021. We’ve narrowed it down to a list of the top 20, and all offer certain perks that could make them the perfect account for you.

Below, you’ll find our top 5 winners to get you started on your search.

See: Best CD Rates and Accounts 2021 – Low Fees & High Yields

Find:These Are the Best Banks of 2021 – Did Yours Make the Cut?

5. Capital One: Top CD Account

Why we like it: Open a CD account with a one cent balance required, online or at a Capital One branch nationwide.

Benefits

- One cent minimum deposit required

- Choose when you receive interest payments: end-of-term, monthly, or annually

- Maturities from 6 to 60 months

- No fees

Drawbacks

- Early withdrawal penalties apply

See what makes Capital One stand out in our full review.

4. Discover Bank: Top CD Account

Why we like it: Relatively high yields and terms from 3 months to 10 years make Discover CDs flexible and well-suited for a variety of consumers.

Benefits

- Maturities from three months to 10 years

- No fees

- High APY

Drawbacks

- High minimum balance requirement

- Early withdrawal fees

Discover Bank offers many outstanding services – explore them in our review.

See: The Best Online Banks of 2021 – Enhanced Services & Low Fees

Find: The Best Checking Accounts of 2021 – High APYs & Low Fees

3. Synchrony Bank: Top CD Account

Why we like it: Synchrony Bank offers great CD rates and numerous maturity options.

Benefits

- Terms from three to 60 months

- 24/7 digital banking

- High APY

- No fees

Drawbacks

- High $2,000 minimum balance

Synchrony was a contender in multiple rankings this year – see why.

2. Ally Bank: Top CD Account

Why we like it: Ally Bank is one of only two banks on the list that has no CD minimum deposit.

Benefits

- Maturities from three months to five years

- No fees

- High yields with larger deposits for some maturities

- Offers Raise-Your-Rate and No-Penalty CDs as well

- 24/7 customer service with a live agent

Drawbacks

- Early withdrawal penalties may apply on some products

Ally Bank rose to the top of multiple categories in our ranking of the top banks in the country this year. We dig into why in our full review.

1. Marcus by Goldman Sachs: Best CD Account

Why we like it: This upstart, user-friendly division of a venerable Wall Street institution offers some of the best available CD rates along with seven-, 11-, and 13-month no-penalty CDs plus a 10-day guarantee you’ll receive the best available rate at the firm.

Benefits

- No fees

- High APY

- Variety of products available

- 10-day CD rate guarantee

- US-based contact center available seven days a week

- Maturities from three months to six years

Drawbacks

Best Cd Accounts 2020

- $500 minimum to open

See Full List On Investopedia.com

Marcus by Goldman Sachs innovates on a number of fronts, which we dig into further in our full review. But remember – if you’re looking for something special in an app, a certain service or other features, every one of our finalists is a great choice and might give you exactly what you’re looking for. Be sure to check out the list of top contenders.

More From GOBankingRates:

Best 1 Year Cd Rates

To discover the Best Certificate of Deposit (CD) accounts, GOBankingRates looked at the top institutions in terms of total assets size that had available published data. To determine rankings GOBankingRates looked at the following factors: (1) total assets as sourced from the FDIC; (2) number of branch locations as sourced from the FDIC; (3) minimum deposit to open an account; (4) 12-month CD APY rate; (5) 60-month CD APY rate, and (5) the average mobile app rating between the android and apple stores. All factors were then scored and combined, with the lowest score being best. Factor (1) was weighted 1.5 times, factor (2) was weighted 2 times, and factors (4) and (5) were weighted 4 times. All data is up to date as of 11/04/2020, rates and fees subject to change.

Best Cd Accounts Online

John Csiszar contributed to the reporting for this article.

Best Cd Accounts 2016

This article originally appeared on GOBankingRates.com: Best CD Rates and Accounts for Your Money