Westpac Term Deposit Interest Rates

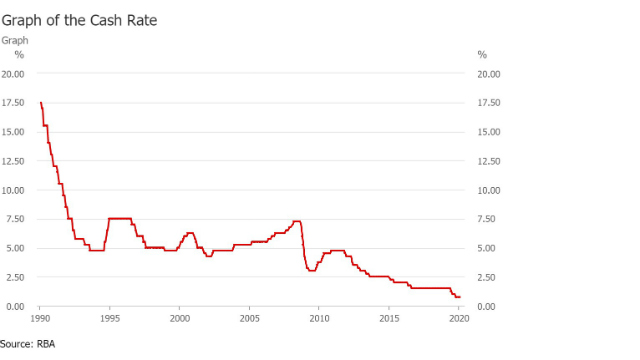

Conditions apply. Offer excludes corporate, institutional and government customers. If you are on a special rate and your Term Deposit rolls over automatically, the Term Deposit may be automatically re-invested at a lower rate than the current interest rate. Major bank Westpac today cut term deposit rates by up to 15 basis points, on terms ranging from three to 24 months. Westpac's 12-month and 24-month deposits have been cut by 15 basis points to 0.85% p.a, down from 1.00% p.a. Other short-term Westpac deposits were reduced by five and 10 basis points, depending on the term. Fixed rate for 12 months. Offer available from 5th February 2021 for a limited time only on Term Deposits opened or renewed by personal customers. Available on deposits from $5,000. According to Westpac, when a term deposit reaches the end of its term, if no instructions have been provided at the beginning of the term or in the six days following the maturity date, then the money will be reinvested according to the same terms at the interest rate applicable at maturity.

- Westpac Term Deposit Interest Rates In Canada

- Westpac Fiji Term Deposit Interest Rates

- Cba Term Deposit Rates Today

- Westpac Smsf Term Deposit Interest Rates

- Westpac Term Deposit Interest Rates

Features and benefits

- No monthly account service fee or establishment fee

- High fixed interest rate on balances of $1,000 and above1

- A range of fixed investment terms available to suit your needs

- Interest paid 6 monthly and at maturity2.

Fees

Westpac Term Deposit Interest Rates In Canada

Refer to the Fiji Customer Service Fees Booklet for details (PDF 98KB)

Here’s what to do.

Westpac offers their personal banking customers a variety of accounts to choose from. They have an everyday banking account called Westpac Choice (their most popular bank account), an online savings account (Westpac eSaver) and term deposit.Other services that they offer include: credit cards, insurance, home loans, personal loans, superannuation, financial planning and share trading.

To open a Westpac personal bank account, you’ll need to provide us with a signed and completed personal account opening form, along with some current identification documents.

We need to verify the following:

- Full name

- Date of birth

- Residential address

- Occupation

- Photo identification and signature

- Citizenship

- Income source documentation

To ensure these 7 points above are verified, we need at least two primary ID documents or one primary plus two secondary ID documents. All documents must be original and current unless specified. If additional documents are required, we’ll let you know.

Download the Opening a Personal Bank Account Brochure (PDF 129KB) for a list of accepted Identification and Additional Identification required for non-residents. Visit your branch or call 132032 for more information.

Need help?

Simply speak to a Banking Representative by calling 132 032.

Things you should know

Conditions apply. Offer excludes corporate, institutional and government customers. If you are on a special rate and your Term Deposit rolls over automatically, the Term Deposit may be automatically re-invested at a lower rate than the current interest rate.

1. Interest rate adjustment may apply if funds are withdrawn before maturity.

2. Once your fixed term ends, you can withdraw your funds via bank cheque, cash or direct credit into another bank account.

You may be eligible for a bonus rate on top our standard rates

Why do I need to sign in to Online Banking to check my rates?

In the past our bankers may have helped you get discretionary rates over the phone or in branch; now you can find out if you’re eligible for discretionary rates by signing into Online Banking.1

Rates may be based on factors such as your relationship with the bank and your existing balances.

You could get higher returns on your surplus cash with our range of fixed term deposits.

Our current term deposit rates are shown below. Look out for our latest special rates marked in red. You should note that:

- Information is current as at 4th June 2019

- Rates for new or renewal term deposits are subject to change at any time. However, once a term deposit account is opened the rate applicable to the account will not change unless the deposit or any part of it is repaid early

- Special rates are not available in conjunction with any bonus interest or other special rates offered by the bank.

Rates shown for a term, e.g. month(s) or year(s) apply up to the start of the next term shown.

| Term | $5,000 <$10,000 | $10,000 <$20,000 | $20,000 <$50,000 | $50,000 <$100,000 | $100,000 <$250,000 | $250,000 <$25,000,000 |

|---|---|---|---|---|---|---|

| 1 < 2 months | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% |

| 2 < 3 months | 1.40% | 1.40% | 1.40% | 1.40% | 1.40% | 1.40% |

| 3 < 4 months | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| 4 < 5 months | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| 5 < 6 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 6 < 7 months | 1.75% | 1.75% | 1.75% | 1.75% | 1.75% | 1.75% |

| 7 < 8 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 8 < 9 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 9 < 10 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 10 < 11 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 11 < 12 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 12 < 24 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 24 < 36 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 36 < 48 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 48 < 60 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 60 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| Term | $5,000 <$10,000 | $10,000 <$20,000 | $20,000 <$50,000 | $50,000 <$100,000 | $100,000 <$250,000 | $250,000 <$25,000,000 |

|---|---|---|---|---|---|---|

| 1 < 2 months | 1.20% | 1.20% | 1.20% | 1.20% | 1.20% | 1.20% |

| 2 < 3 months | 1.35% | 1.35% | 1.35% | 1.35% | 1.35% | 1.35% |

| 3 < 4 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 4 < 5 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 5 < 6 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 6 < 7 months | 1.70% | 1.70% | 1.70% | 1.70% | 1.70% | 1.70% |

| 7 < 8 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 8 < 9 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 9 < 10 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 10 < 11 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 11 < 12 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 12 < 24 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 24 < 36 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 36 < 48 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 48 < 60 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 60 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

For rates on other balances, terms and interest payment frequencies please call 132 142 (8am-8pm, 7 days a week).

Interest options are:

- Interest paid at maturity is available for terms of 12 months or less

- Interest paid monthly is available for terms of 1 to 60 months (inclusive)

- Interest paid annually is available for terms of greater than 12 months (for terms not equalling an exact year, the remaining interest is paid at the end of the term).

If some or all your business term deposit is repaid early:

- In most cases an interest rate adjustment will apply

- We reserve the right to vary the interest rate adjustment at any time

- If interim interest has been paid and the Term Deposit is repaid before maturity, we reserve the right to recover repayment of this interest

- No interest will be paid if the Term Deposit is repaid within the first 7 days of a Term.

The interest rate adjustment will not apply where a term deposit is repaid prior to maturity due to the death of the depositor.

Call us on 132 142 or visit a branch:

Westpac Fiji Term Deposit Interest Rates

- To invest amounts over $250,000

- If you want to open a Term Deposit for a term other than those shown above.

Cba Term Deposit Rates Today

Manage your Term Deposit online:

- Westpac Live allows you to manage your eligible Term Deposits online during the Six Business Day Variation Period.

Business Term Deposit

No set-up, monthly service or management fees (other fees may apply)

Westpac Smsf Term Deposit Interest Rates

Open a Business Term Deposit

It only takes 10 minutes

Renew your Term Deposit online

Manage your eligible Term Deposit online during the Six Business Day Variation Period

Things you should know

Important Information Document (PDF 119KB)

Westpac Term Deposit Interest Rates

1. Any discretionary rates offered above may only be available through Westpac Live Online Banking.

Customers must provide a minimum 31 days' notice to access funds prior to maturity (except in cases of hardship). If the rate applying to your term deposit is a special or standard rate and your term deposit rolls over automatically, it may be automatically re-invested at a lower rate than the initial rate (including any initial special rate).

Early withdrawal may reduce returns. Term Deposits are 'protected accounts' under the Financial Claims Scheme (FCS). Payments under the FCS are subject to a limit for each depositor. For more information see the APRA website at apra.gov.au. This information does not take into account your personal objectives, financial situation or needs. Read the Terms and Conditions (PDF 3MB) and Important Information Document (PDF 119KB) before making a decision and consider whether the product is appropriate for you. Other fees, charges, terms and conditions apply.