Pay In Cheque Online

Convert Paper Checks to Paperless Digital Checks. Or print checks online of any bank on any paper using any printer. Pay & Get Paid by eCheck via email or phone. All Pay Stubs you need this session. No Max - Log On - View your stubs - Easy download. Instant Download as many times as you want. DEAL - Get Discount - Send us a Picture of yourself, and a sign saying you love PayCheckStubOnline and get $10 off, 30% discount. Satisfaction Guarantee.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Chase Online℠ Bill Pay

Pay bills securely from virtually anywhere

- Overview

- Getting started

- FAQs

- Resources

- Pay all your bills with no fees on the Chase Mobile® app or Chase Online℠ without sharing your account details.

- With our Online Bill Payment Guarantee, your payments will be sent on the date you specify.

- Get reminders with eBills when a bill is due.

- Set up automatic bill payments on Chase Online℠.

- Easily add a payee on the Chase Mobile® app by snapping a picture of your bill or uploading a screenshot of the bill.

- Pay your bills and pay your friends from one place, no need for checks.

- Stay up to date on the status of your payments and when money leaves your account.

How to make online bill payments

Sign in to Chase Online℠ or the Chase mobile app and sign up for Chase Online Bill Pay. Choose “Pay Bills” in the navigation menu.

Choose “Add a payee” or “Manage payees,” enter the requested info and complete the flow.

Once you complete the setup, you’ll be ready to pay any bill or any person all in one place.

Common questions answered about Online Bill Pay

How does the Online Bill Payment Guarantee work?

expandYour payments are important to us—so important that we guarantee they’ll be sent on the “Send On” date you specify. If Chase ever delays your personal Chase Online℠ bill payment, we'll cover late fees that result from the delay if you have followed these simple guidelines:

- We receive your payment request by the Cutoff Time, sufficiently in advance of the payee’s due date for the payment to arrive on time (before the interest-free period begins).

- You input the Payee information correctly.

The risk of incurring and the responsibility for paying any and all late charges or penalties shall be borne by you in the event:

- you do not follow the procedures or otherwise fail to use the Bill Payment & Transfer Service in accordance with the terms of the Online Service Agreement or

- you enter into any agreement where one of the purposes is to generate late payment fees. Our guarantee does not cover errors made by your payee or your payee’s change to a delivery method that increases processing time for your payments.

How does paying bills online work?

expandWith Online Bill Pay you can pay and manage your bills in one place. Pay virtually anyone—your utilities, credit cards, even your landscaper. Payments are secure, and you can schedule a one-time or repeating payment while eliminating the need for postage.

Depending on the type of payee, your payment will be made electronically (delivered in 1 or 2 days) or by paper check (delivered in 5 days). We’ll make payments to your Chase payees the same day if you schedule them before the Online Bill Pay cutoff time.

With eBills, you can get your statements delivered right to the Chase Mobile® app or Chase Online℠.

How do I schedule one-time payments?

expandSign in to Chase Online℠ or the Chase Mobile® app and choose “Pay bills” then “Schedule payment” in the navigation menu. Choose your payee, enter the amount, “Pay from” account and the “Send on” or “Deliver by” date, then verify your details and submit. You'll see a payment confirmation where you can save or share your payment receipt.

Does it cost anything to pay bills online?

expandNo, there's no additional cost to use Online Bill Pay.

What’s an eBill?

expandOnce you're enrolled in Online Bill Pay, you can sign up to get eBills which is an electronic version of the paper bill or statement you receive each month from any company including telecom, utilities or retailers. The electronic bill will include all the same details and information your paper bill contains.

How do I sign up for eBills?

expandOnce you're enrolled in Online Bill Pay, go to the Schedule payment screen where you’ll see the payees eligible for eBills. Follow the enrollment process to enroll your payee into eBills.

How do I add a payee with a picture on the Chase Mobile® app?

expandSign into the Chase Mobile® app and choose 'Pay bills,' then 'Manage payees' in the Navigation menu. Tap 'Add a payee.' Input your payee name in the Search field and a list of potential matches will appear as well as the option to add manually. After selecting to 'add manually' or choose a 'Potential match,' tap on 'Add payee with a picture of your bill' and complete the flow by either snapping a picture of your bill or uploading a screenshot of your bill.

How do I set up Automatic bill payments on Chase Online℠?

expandSign in to Chase Online℠ and choose 'Pay & Transfers,' then choose 'Payment Activity.' From there choose 'Automatic payments' under 'Bill Pay' in the side menu; choose 'Set up an automatic payment' and complete the flow. Please add your desired payee before setting up automatic payments.

What's new with Online Bill Pay?

expandYou can now add a payee for online bill payments by taking a picture of your bill or uploading a screenshot of your bill with the Chase Mobile® app and we'll fill in the payee details. You can also set up automatic bill payments for the eBills you have set up—choose the amount, frequency and date when you want us to send the payment. Continue to manage all of your payments from one place, whether it's to your friend using Chase QuickPay® with Zelle® or your mobile phone bill. You can take action on your upcoming Chase credit card payments, eBills and Chase QuickPay® with Zelle® requests all in one place. You can also stay updated on the status of your payments and when money leaves your account.

Have more questions?

24/7 access to deposit funds

- Chase QuickDeposit℠ — Securely deposit checks from almost anywhere.

- Chase ATMs — Conveniently deposit up to 30 checks and cash at most ATMs.

- Direct deposit — Automatically deposit paychecks.

Pay bills quickly & conveniently

- Online Bill Pay — Pay rent, mortgage, utilities, credit cards, auto and other bills.

- Chase QuickPay® with Zelle® — Send and receive money from almost anyone with just a mobile number or email address.

Pay In Cheque Online

Helpful technology that saves you time and keeps you in the know

- Paperless statements — Digitally access up to 7 years of statements.

- Account alerts — Monitor finances, avoid overdrafts and more.

- Chase text banking — Check balances and transaction history with a text.

The days of waiting nearly a week for a cheque to clear could soon be over, as a new system introduced yesterday aims to revolutionise one of the more old-fashioned payment methods.

New technology launched by the Cheque & Credit Clearing Company means cheques paid in on a weekday could soon clear before midnight the following evening, rather than taking up to six working days.

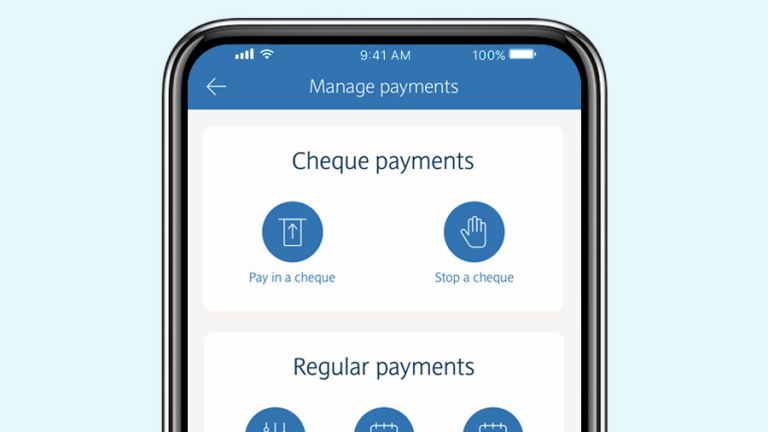

From early next year, some banks will even allow you to pay in cheques using their mobile banking apps.

Cheque imaging: how will it work?

With the new technology, the old paper-based clearing system will be phased out. Instead, the bank will create a digital image of the cheque, so that each payment can be processed more quickly.

While the new clearing system officially launches today, banks have until summer 2018 to fully adopt the new technology.

/Balance_Pay_To_Cash_Checks_315313_V3-74332e1e27cf4ba48c7cc043660d07ce.png)

Once they do, it’ll work like this: if a customer pays a cheque in on a weekday, it’ll be cleared by 11:59pm the following day at the latest. Over a weekend or bank holiday, the cheque will clear by the following working day. Once the system is fully rolled out, payments may move even more quickly.

Some banks are also set to offer cheque imaging through their online banking apps – meaning you might soon be able to pay in a cheque from the comfort of your own home.

What will happen in the meantime?

While the new system is in the process of being rolled out, the old clearing system will operate parallel to it. Initially, imaging will only be available to a small number of cheques before growing gradually over the coming months.

In the short term, this means you might face some uncertainty over how long a cheque will take to clear, as some will still take up to six working days using the old paper method.

For now, customers are being advised to contact their bank to find out when they’ll be adopting the new technology. But don’t worry – you’ll still be able to pay cheques in at your bank or building society branch, using an ATM or by post.

Which banks are leading the change?

Bank of Scotland, Barclays, Halifax, HSBC, Lloyds, Nationwide and Santander are front-runners in adopting the new clearing system from today, with NatWest and RBS set to follow early in 2018.

While Barclays already allows customers to deposit cheques worth £500 or less using its app, this service is currently limited to Barclays cheques.

None of the major banks are currently accepting competitor cheques through their apps, though this will change in early 2018, with Bank of Scotland, Barclays, Halifax and Lloyds all expressing an intention to be early adopters.

Do people still use cheques?

In 2011, the banking industry announced plans to phase cheques out entirely by 2018 – but it’s safe to say that’s unlikely to happen.

Definition Of A Cheque

Partly, this may be due to pressure from MPs, who suggested older people still rely on cheques as a day-to-day form of payment.

While it’s true that cheque usage might be in decline, a whopping 477 million were written in 2016 – meaning the days of the humble cheque are unlikely to be over anytime soon.